Attendance Allowance is a tax free, non means tested benefit for someone who suffers from an illness/disability and has care and/or supervision needs. To qualify you must:

- be state pension age when applying

- have had a need for at least 6 months and expect to have needs for at least another 6 months.

- Satisfy presence and residence rules

There are special rules for people with a short life expectancy, when the qualifying period does not apply.

Attendance Allowance may be awarded at one of two rates (2024/25);

1) Higher rate £108.55 if the need is through the Day and Night

2) Lower rate £72.65 – if the need is through the Day or Night

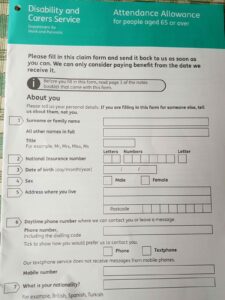

Please get in touch if you would like some help to understand whether you may be eligible or need some help to fill in the form

Attendance Allowance – FAQ’s

Will my condition qualify for Attendance Allowance?

Attendance Allowance is about the help and supervision that you need rather than the illness or disability that you are living with. You will be asked about your condition but any award is determined by how it affects your ability to manage day to day personal care/bodily function and/or the supervision that you require to be safe, not a specific diagnosis.

Can I get Attendance Allowance if I have savings?

Attendance Allowance is a non-means tested benefit. There is no financial assessment, so your savings will not affect any entitlement.

Can my mum and dad both claim Attendance Allowance?

Yes, providing that as individuals they are eligible and meet the qualifying criteria. Attendance Allowance is awarded to the person that requires the care and/or supervision and if both parents have needs of their own then they may both apply and be awarded.

What other benefits can I get with Attendance Allowance?

Attendance Allowance is a stand-alone disability related benefit but it is also a ‘qualifying’ benefit for means tested benefits eg; Pension Credit, Council Tax Support/Housing Benefit. It can act as a ‘passport’ to other beenfits. Means tested benefits are not dependent on receipt of Attendance Allowance BUT it can add an extra element or ‘premium’ to the way your entitlement is worked out.

Receipt of Attendance Allowance indicates a need for support and it may be worth requesting a care needs assessment from the Local Authority, which may provide for or pay towards care and support

There may be other ways to help and/or pay for your support needs. Care Funding and Benefit Advice will identify your benefit entitlement and help you to access services

Is Attendance Allowance taxable?

Attendance Allowance is NOT taxable or means-tested – so your savings or income won’t affect your claim.

Can you get a mobility car if you claim Attendance Allowance?

No. You cannot apply to join the Motability Scheme if you receive Attendance Allowance. Personal Independence Payment or Disability Living Allowance Mobility components at the Enhanced rate are ‘qualifying’ benefits but Attendance Allowance is not because as it does not have a separate mobility component.

Do people on Attendance Allowance get council tax reduction?

You may qualify for Council Tax Reduction as a means tested benefit without receiving Attendance Allowance but Attendance Allowance can often act as a ‘qualifying’ benefit which may passport you onto or increase a means tested benefit entitlement.

There are other ways that you can get help with Council Tax. Exemptions, Council Band Reductions… Read our Council Tax article here

How can I increase my Attendance Allowance?

Attendance Allowance is paid at one of two rates – Lower or Higher. If you are receiving the Lower rate and have additional Day/Night needs and have had for more than 6 months contact the Department for Work and Pensions (DWP) to tell them of the change in need and request an upgrade application form.

You will only usually need to tell them of the additional needs (the lower rate is commonly awarded for daytime need with the additional needs being during the nighttime)

How long can you stay on Attendance Allowance?

You might have been given Attendance Allowance for an indefinite period. This doesn’t mean for the rest of your life – it just means there’s no fixed date for the DWP to review your claim.

Can you get PIP and Attendance Allowance?

No. Personal Independence Payment (PIP) is a working age disability related benefit, Attendance Allowance is for people over State Pension. It is possible for someone to remain on Disability Living Allowance if they were already over 65 in April 2013 but you cannot receive both.

Can I get a blue badge if I get Attendance Allowance?

The Blue Badge is not dependent on Attendance Allowance, if you have significant mobility restrictions (and other reasons for not being able to be too far from the car) apply to the Local Authority.

Can I receive Attendance Allowance in a Care Home?

Yes, providing you are paying for your own care without financial contribution from the Local Authority. You will not be able to claim Attendance Allowance if receiving NHS Continuing Healthcare funding or your care is being paid for under Section 117 of the Mental Health Act but it is payable of the NHS is paying a Funded Nursing Care Payment for your care in a Nursing home if you are self-funding that care.

Thank you for reading this weeks blog, Attendance Allowance (AA)

If you would like some help please Get In Touch.

Care Navigators

(May 2024)