Benefits

The benefits that are relevant to you depend on your age and circumstances. Some are means tested, but many are not although they may depend on National Insurance Contributions for example State Pension.

Benefits Checklist

Check below for the benefits that may apply to your circumstances with means tested benefits in RED , non-means tested benefits that are not dependent on National Insurance contributions in GREEN and non-means tested benefits that are dependent on National Insurance contributions in BLUE .

Child Benefit

Child BenefitChild Tax Credit

Guardians Allowance

Maternity Grant

Maternity Allowance

Statutory Paternity / Maternity / Adoption Pay

Widowed Parent Allowance

Free School Meals / Milk

Universal Infant Free School Meals

Healthy Start Scheme

Job Seekers Allowance

Job Seekers AllowanceEmployment Support Allowance

Working Tax Credit

Universal Credit

Incapacity Benefit (no new claims since 2008)

State Retirement Pension

Statutory Sick Pay

Attendance Allowance – 0800 731 0122

Attendance Allowance – 0800 731 0122Disability Living Allowance – 0800 121 4600 (no new claims)

Personal Independence Payment – 0800 917 2222

Carers Allowance – 0800 731 0297

Statutory Sick Pay

Industrial Injuries Disablement Benefit

Bereavement Allowance

Bereavement Payment

Winter Fuel Payments

Pension Credit – 0800 991 234

Pension Credit – 0800 991 234Universal Credit

Income Support

Local Emergency Support

Budgeting Advance / Loans

Housing Benefits / Costs

Council Tax Support / Reduction / Exemption

Cold Weather Payments

Funeral Payments

Health Costs – Prescription, Dental Costs, Eye Tests / Glasses, Travel To Hospital, Wiggs

Boiler Grant

Loft and Cavity Wall Insulation Grants

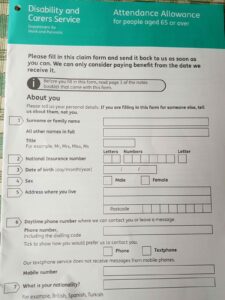

Attendance Allowance (AA) – 0800 731 0122

Attendance Allowance is a tax free, non means tested benefit for someone who suffers from an illness/disability and has care and/or supervision needs. To qualify you must be state pension age when applying and have had a need for at least 6 months and expect to have needs for at least another 6 months. There are special rules for people with a short life expectancy, when the qualifying period does not apply. Attendance Allowance may be awarded at one of two rates (2025/26);

- 1) Higher rate £110.40 if the need is through the Day and Night

- 2) Lower rate £73.90 – if the need is through the Day or Night

Find our Attendance Allowance guide in the library

Attendance Allowance – An Introduction

How to fill in an Attendance Allowance form:

If you need some help to complete the form, we can arrange a video call or home visit. Please contact us or make an appointment.

Disability Living Allowance (DLA) – 0800 121 4600

Disability Living Allowance (DLA) has been replaced by Personal Independence payment. There are no new claims for DLA, however if you were born on or before 8 April 1948 and in receipt of DLA you will continue to receive it (for the length of the award and providing you still meet the qualifying criteria) and it can be upgraded as needs change providing the qualifying period and criteria are met.

If you would like some help to complete a form or appeal a benefit decision please contact us.

Personal Independence Payment (PIP) – 0800 917 2222

PIP is non-means tested and non-taxable benefit for people who are 16 years or over with a long-term physical or mental health condition or disability that affects their ability to do daily living tasks. It replaced DLA for working age claimants and has two parts; Daily Living Component and Mobility Component which can be upgraded as needs change, providing the qualifying period and criteria are met.

PIP is dependent on you meeting the 'Descriptors' of the benefit. If you would like some help to complete a form or appeal a benefit decision please contact us.

Our Benefits advice is not free of charge but we do offer a 10 minute free fact find appointment and you can request our FREE PIP Descriptors information sheet below to help you get an idea of the criteria of this non-means tested benefit.

Carers Allowance – 0800 731 0297

A non means tested, taxable benefit payable for those who look after someone receiving a qualifying disability benefit such as Attendance Allowance/DLA Care component at the middle or high rate/ PIP daily living at either rate. You do not have to be related to, or live with, the person that you care for but will be aged 16 or over, spend at least 35 hours a week caring and not earn over a set amount per week after deductions. Carers Allowance may affect any means tested benefit that the disabled cared for person receives.

Pension Credit – 0800 99 12 34

Pension Credit is a means tested, non-taxable benefit. You must live in England, Scotland or Wales and have reached State Pension age to qualify for Pension Credit. It is one of the most under claimed benefits as entitlement may vary with a change in circumstances and new entitlement can be overlooked.

It has no savings/capital upper limit, although over £10’000 will be given an assumed income of £1 for every £500 or part of.

To understand your benfeit entitlement please contact us for a full benefit check

Council Tax Support

Because Council Tax reduction/support/benefit is usually means tested for it to apply as non-means tested support it has to be based on a property or person being exempt. Disregarding a person or providing a discount to a household situation rather than applying a financial assessment to an individual.

One of the more common exemptions is for someone who is moving into a care/nursing home when the property is exempt or for someone living at home with a ‘severe mental impairement’ when the person is exempt.

This is one of the most under claimed benefits and can make one of the biggest differences. Please read our article here or contact us for a benefit check to understand your full benefit entitlement.

Unclaimed Benefits

Please don’t be one of the 4 out of 10 older people with unclaimed benefit entitlement. More than 80% of the people we speak to have benefits that haven’t been claimed, for lots of reasons but usually because they didn’t know or thought that they were getting everything they could.

Listen to our Podcast to find out why! Click Here For Podcast

These are just a few of the many benefits left unclaimed:

- Pension Credit

- Funeral Payments

- Council Tax band reduction scheme/Council Tax exemption

- Employment Support Allowance

- Health Related Costs

- Industrial Injuries Disablement Benefit

Challenging a Benefit decision

If you don’t agree with a decision you have received we can explain if and how to ask the DWP to look at it again. Advice is fundamental to making a successful claim and changing a decision you are not happy with. We specialise in disability related benefits such as Personal Independence Payment and Attendance Allowance and can guide you through the process step by step with a 99% success rate for claiming and challenging these non means tested benefits.

Find our ‘How to challenge a DWP Benefit decision’ guide in the library

How can we help? It is easier to get it right fromt the beginning and it is better to get some help with the inital application. But, if you have been refused we can help you to work out whether it is worth challenging a decision with a free 10 minute call. If a successful outcome is likely we can help with a challenge, charged at an hourly rate which may also include support at tribunal.

If you are not sure whether you will qualify, would like some help to fill in a form or to challenge a decision get in touch.

FAQ

What is the difference between PIP and Attendance Allowance?

Put simply, your age. Both are non means tested benefits for people who are living with a disability or illness that means they have care or supervision needs. You can’t claim Attendance Allowance until you are 65 years old and PIP is for people of a working age. If you would like some help to understand your benefit entitlement please get in touch

Can I get DLA and AA?

No, they are both non means tested benefits but for people of different ages and you cannot receive both at the same time. If you are not sure whether you are receiving the right benefits please get in touch

What can you spend Attendance Allowance on?

Anything that makes your life easier, Attendance Allowance is not ring fenced and does not have to be spent on paid carers. If you are not sure whether you are receiving the right benefits please get in touch

What other benefits can you get with Attendance Allowance?

Attendance Allowance is a non means tested disability related benefit BUT it may passport you onto other benefits. Please get in touch if you would like a full benefit check.

What should I write on the Attendance Allowance form?

You will have to satisfy certain criteria to qualify for Attendance Allowance. Take a look at our video on how to fill in the form and if you need any more help let us know please get in touch

Can I get Carers Allowance for looking after my parents?

Whether you are eligible to claim (or receive) Carers Allowance will depend on the benefits your parents receive, how many hours you spend caring and whether you earn a wage and if so how much. Claiming Carers Allowance may affect other benefits your parents receive. Please get in touch for a benefit check to find out whether to claim or not

Can I get help with Council tax?

That will depend on your circumstances. If you are on a low income or have moved in to a care home, use a wheelchair indoors or are living with a severe mental impairment there may be support for you. Read more in our article here or if you would like to make sure you are claiming all of the benefits you are entitled to please get in touch