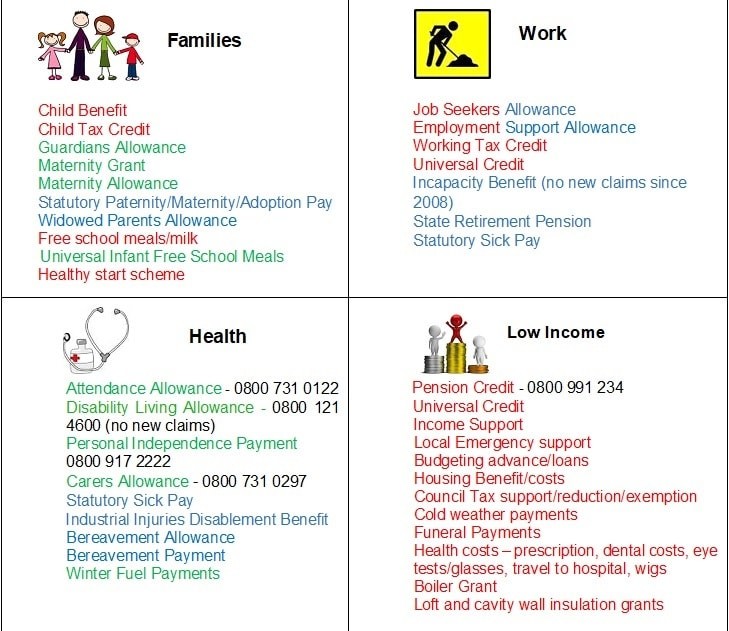

Later Life Benefits explained. The benefits that are relevant to you depend on your age and circumstances. Benefits are split into two types, means tested and non-means tested. Some non-means tested benefits are dependent on a National Insurance Contribution record for example State Pension.

The table below shows means tested benefits in RED, non-means tested benefits that are not dependent on National Insurance contributions in GREEN and non-means tested benefits that are dependent on National Insurance contributions in BLUE.

Attendance Allowance (AA) – 0800 731 0122

Attendance Allowance is a tax free, non means tested benefit for someone who suffers from an illness/disability and has care and/or supervision needs. To qualify you must be 65yrs or over old when applying and have had a need for at least 6 months and expect to have needs for at least another 6 months. There are special rules for people with a short life expectancy, when the qualifying period does not apply. Attendance Allowance may be awarded at one of two rates;

- 1) Higher rate £89.60– if the need is through the Day and Night

- 2) Lower rate £60.00 – if the need is through the Day or Night

Disability Living Allowance (DLA) – 0800 121 4600

Disability Living Allowance has been replaced by Personal Independence payment for people aged between 16 and 64 yrs. No new claims for DLA, however someone who was already 65 years old on the 8th April 2013 and in receipt of DLA will continue to receive it (for the length of the award and providing they still meet the qualifying criteria) and it can be upgraded providing the qualifying criteria are met.

PIP – Personal Independence Payment – PIP Claim line 0800 917 2222

The Welfare Reform Act 2012 introduces Personal Independence Payment (PIP) as part of wider welfare reform. It is non means tested and non-taxable and will replace DLA for eligible claimants aged 16 to 64 from 8th April 2013.

Carers Allowance – 0800 731 0297

A non means tested, taxable benefit payable for those who look after someone receiving a qualifying disability benefit such as Attendance Allowance/DLA Care component at the middle or high rate/ PIP daily living at either rate. You do not have to be related to, or live with, the person that you care for but will be aged 16 or over, spend at least 35 hours a week caring and not earn over £128 (net) per week after deductions. Carers Allowance may affect any means tested benefit that the disabled cared for person receives.

Pension Credit – Claim line; 0800 99 12 34

Introduced in 2003 it is a means tested, non-taxable benefit for people over the qualifying age which is in line with the Women’s State retirement age. Entitlement varies depending on the circumstances. It has no savings/capital upper limit, although over £10’000 will be given an assumed income of £1 for every £500 or part of.

4 out of 10 older people have unclaimed benefits. Listen to our Podcast to find out why!

These are just a few of the many Later Life Benefits left unclaimed:

- Funeral Payments

- Council Tax band reduction scheme/Council Tax exemption

- Employment Support Allowance

- Health Related Costs

- Industrial Injuries Disablement Benefit

Please contact us for a full Later Life Benefits check:

- Telephone; 0800 999 25 27

- Email; help@careadvisernetwork.co.uk

If you would like some help with Later Life Benefits please Get In Touch.

Care Navigators