Assessing an individual for care fees - Joint bank accounts

To receive financial support from the local authority for Adult Social Care, they will have to assess and agree your care needs, confirming that you meet the eligibility criteria. Only then can a financial assessment work out who pays what…

In England the council generally helps to pay for care costs if you have savings less than £23,250 but your income will also be assessed and if high may mean that you are ‘self-funding’ on income alone even if your savings are below the £23’250 upper funding level.

The financial assessment is free and happens after a needs assessment or carer’s assessment.

Your local authority cannot include capital or income belonging to your partner in your financial assessment. Each person must be treated as an individual

Private Pensions

If you enter a care home permanently and have a personal or private pension, an occupational pension or a retirement annuity, you can choose to pass 50 per cent to your partner remaining at home. This amount must be excluded or disregarded from a local authority financial assessment.

Before deciding whether to take advantage of the 50 per cent disregard, you should consider whether it benefits your partner financially. This is because receiving extra income can affect their entitlement to means tested benefits such as Pension Credit, Housing Benefit or Council Tax Reduction.

Joint Savings

Statutory guidance describes the local authority’s power to divide a jointly held capital asset equally ‘except where there is evidence that the person owns an unequal share.’ If your savings are held jointly, half of the amount will be assessed as belonging to the person who needs the care.

Separating Joint Accounts

Separating jointly held savings into individual accounts may make keeping track on care fees and bills more manageable BUT if you take half from a joint account and put it into the name of the partner not requiring the care, intending the Local Authority to split the remainder of the joint account it could be considered deliberate deprivation. Both Financial and Legal advice may be required.

Power of Attorney

Sometimes children have a Power of Attorney for both parents which can cause a conflict if joint funds require separating or one partner requires more financial input than another, for example when care fees are needed. When this applies it is appropriate to bear in mind the Principles of the Mental Capacity Act 2005 and be guided by the Code of Practice. A Power of Attorney requires the Attorney to act in the ‘Best Interest’ of the person who no longer has the mental capacity to manage the decision. Both Financial and Legal advice may be required

Deprivation of Assets

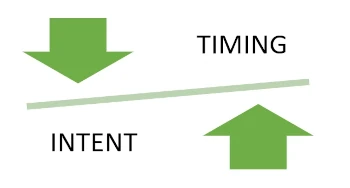

Depriving yourself of an asset isn’t always done with the intention of avoiding paying for care. Both timing and intent is important. Before looking at the reason for the deprivation a Local Authority will consider when you reduced your assets and whether you could reasonably expect to need care and support.

Avoiding paying for care may not be the reason for reducing your assets or making a gift and a local authority should consider both the timing and intent before deciding whether the purpose of the deprivation is avoiding care and support charges as people with care and support needs are free to spend their income and assets as they see fit, including making gifts to friends and family.

If you would like some help please Get In Touch.

Care Navigators

(November 2022)