Paying for care? Should you be? Follow these top ten tips if you are choosing care for a loved one to help you with the cost of long-term care and how appropriate, affordable and sustainable it is.

1. Knowledge is power –

The power to choose care that is right for you, affordable and sustainable, knowing what you need to know will help you provide continuity of care and avoid a move later on or needing to reduce the support if the money runs out.

We don’t know what we don’t know. It’s easy to be guided by other people, especially if you are tired and have little time or no previous experience of the care and benefit system but do you really want to rely on that when you are engaging one of the most expensive services of your lifetime without getting expert advice?

Informed decisions can only be made with ALL of the relevant information. True, there can come a point when you have information overload but without knowing what you need to know, personalised for your circumstances how can you make good choices? Expert care and care funding advice can help you choose appropriate care and make sure you are not paying for care that you shouldn’t be or for longer than you need to.

2. Understand the variables - paying for care

Residential care costs, on average, more than £35,000 a year. A nursing home can cost more than £45,000 a year and in some areas for example the South East, care fees can be much higher than in others. Often ’self-funders’ will pay more for a place in the same home as someone who is supported by a Local Authority or funded by NHS Continuing Healthcare.

Bear in mind that needs may change and this often affects the cost of care, it is also usual for an annual increase in care fees. The Local Authority must provide certain things free of charge and it is worth contacting them to find out how they can help. Did you know for example the Local Authority must help you arrange care at home if you ask? Not the same as paying for it!

3. Care and Housing Options

Before making a life changing decision make sure you are aware of your options. Often our choices depend on location and cost so it’s worth finding out what help there is and what services are FREE of charge. What’s the difference between a Residential care home and a Nursing home? Would Live In care be more suitable than moving into care permanently, will the Council pay if you run out of money or if they don’t agree with your chosen provider or setting?

Considering all of the care options is easier said than done if you don’t know what they are or what is available. Care Navigators can help you narrow down your options and find providers that suit your needs.

4. Choosing the right care

Avoid over- spending on care that you don’t need or learn to rely on and wouldn’t qualify for if the money runs out. The right care starts with the right advice and claiming benefits, getting the right assessments can lead to additional money to help you pay for your choice of care.

Carers coming into your home several times a day may be daunting and feel intrusive. It’s easier to ‘get on with it’ and hope no one notices that you may be struggling! It’s not always easy to talk to your family or accept that you need some help but it may be better to accept some support before either a loved one can’t manage or something goes wrong and you find that you are no longer in control?

Asking the right questions, making sure you are getting the help that you want, when you want it are things that Care Navigators can help you with.

5. More haste less speed

Sometimes there is a need for swift action but before making life changing choices think about why you have come to this decision. Moving into a care home can’t stop you falling and if you are lonely at home moving into a care home isn’t necessarily the answer. A period of respite leading to long term care is common but ask yourself, is this choice sustainable? If not, what happens when the money runs out? Don’t rush into signing anything before knowing what else may be available.

6. Property

Don’t assume that you will have to go into a home and sell the house. Often your home is disregarded from a Local Authority financial assessment, for example if you and/or your partner, a family member over 60 years old or disabled are living in it. Please don’t assume that you will have to sell the house to pay for your care and seek advice.

There are products such as Equity Release that you may want to consider for help at home or Care Fee Annuities that can pay for care and support at home or in a care home. The Local Authority may be able to make a Deferred Payment Agreement if you are moving into a care home and don’t want to or can’t sell.

Moving, downsizing, sharing or renting may work for you and with most people preferring to stay at home Adult Social Care and NHS services may also be able to help you to remain independent.

7. Help from the state –

Both the NHS and Adult Social Care (also known as the Council or Local Authority) have services that are FREE of charge, regardless of whether you will be ‘self- funding your care’ or not. NHS Funding is free from a means test but apart from a few things that must be provided free of charge, for example an Occupational Therapy assessment, Adult Social Care is usually means-tested with an upper funding level of £23’250 (England 2019/20).

Claim your benefit entitlement! There are more non-means tested welfare benefits than those that are means tested, many are left unclaimed and often this is a lack of awareness rather than a reluctance to claim. Make sure you have the facts and avoid paying for care when you shouldn’t be or for too long.

8. Planning ahead -

It isn’t always possible to plan for a future care need as we don’t know when or what to make provision for but there are a few things that can make life easier for those closest to you if that time comes.

Making and Registering a Power of Attorney while you are still able to choose someone you trust will save you time and money and can give peace of mind that your wishes are known and followed, should there be a time when you are not able to make your own decisions unassisted.

Making or updating a Will, Estate planning and financial advice can also be done sooner rather than later or before a point of crisis.

9. Give yourself a break

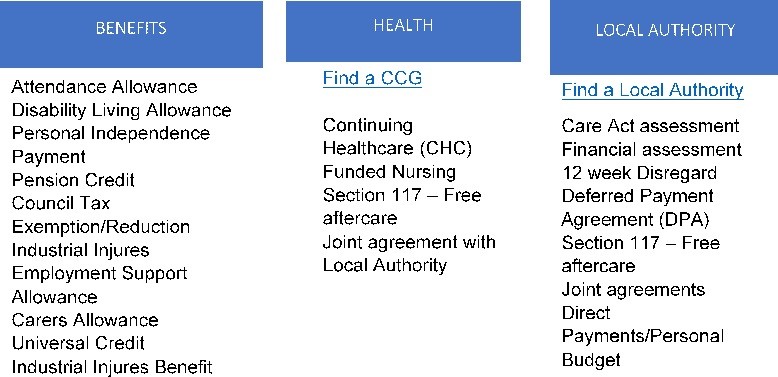

10. Funding Tree – If you aren’t sure what some of these things are or if they apply to you, get expert advice

Most people would prefer to stay at home given the choice. There are 7 million carers in the UK. 1 in 5 people between 50- 65 years are carers, and 65% of older carers live with a disability of their own. Don’t wear your self out or suffer in stoic silence. Getting help sooner rather that later can help you stay at home or care for a loved one for as long as possible.

It doesn’t mean losing your independence or intrusive care, take it slowly and build the help up if needed. Don’t be too hard on yourself if you are caring and find it’s getting too much, this is not a failure! Seek advice and accept support.

The power to choose care that is right for you, affordable and sustainable, knowing what you need to know will help you provide continuity of care and avoid a move later on or needing to reduce the support if the money runs out.

We don’t know what we don’t know.

It’s easy to be guided by other people, especially if you are tired and have little time or no previous experience of the care and benefit system but do you really want to rely on that when you are engaging one of the most expensive services of your lifetime without getting expert advice?

Informed decisions can only be made with ALL of the relevant information. True, there can come a point when you have information overload but without knowing what you need to know, personalised for your circumstances how can you make good choices? Expert care and care funding advice can help you choose appropriate care and make sure you are not paying for care that you shouldn’t be or for longer than you need to.

If you would like some help with Paying For Care please Get In Touch.

Care Navigators