Navigating the financial aspects of paying for care can be overwhelming, especially when you’re faced with important decisions about care homes or home care. Whether you’re wondering who covers care costs or how the system works, we have answered the most common questions about paying for care and the available funding options.

-

Who Pays for Care?

A question many ask is, “Who is responsible for paying for care?”.

Care costs may be covered by:

- Self-funding: If your assets exceed £23,250, you may need to cover all care costs.

- Local authority funding: For those with assets below £23,250, the local council may contribute based on a financial assessment.

- NHS Continuing Healthcare: If you have complex medical needs, the NHS may cover all your care costs, including accommodation this can pay for care wherever you live.

-

How Does the Local Authority Assess What I Pay?

For those eligible for local authority support, a means test is conducted. It considers:

- Income (pensions, benefits)

- Assets (savings, capital and property)

The local authority determines how much you pay, if anything, based on this assessment. Your home may be disregarded, please seek advice before making life changing decisions or selling your property.

-

Will I Have to Sell My Home to Pay for Care?

This is a big concern for many. Thankfully, in many cases, you won’t need to sell your home:

- If you receive care at home, your home’s value isn’t included in a Local Authority financial assessment.

- If you’re in a care home but a spouse or dependent relative (over 60 or disabled) still lives in your home, it’s usually disregarded.

For those needing to cover costs later, the Deferred Payment Agreement can help.

-

What is the Deferred Payment Agreement?

The Deferred Payment Scheme allows you to delay paying for permanent care by using your home’s value as security for the Local Authority. Payment is deferred until your property is sold or after your passing.

-

What Financial Help is Available?

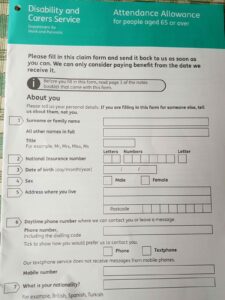

Various benefit are also available, such as:

- Attendance Allowance: For those over 65 needing personal care or supervision

- Personal Independence Payment (PIP): For those under 65 with care or mobility needs

- Carer’s Allowance: For someone of a working age who is caring for you for over 35 hours a week and earning less than the benefit threshold.

You can also ask your local authority for a needs assessment to determine eligibility for care funding.

-

What is NHS Continuing Healthcare?

NHS Continuing Healthcare (CHC) is a fully-funded care package for those with complex medical needs. If you qualify, all care costs are covered by the NHS, whether you’re at home or in a care home.

-

Can I Get Help with Nursing Care Costs?

For those requiring nursing care in a care home, NHS Funded Nursing Care (FNC) offers a weekly contribution towards nursing services. This is separate from NHS Continuing Healthcare and is currently £235.88 per week (April 2024).

-

What Happens If I Can’t Afford to Pay for Care?

If you can’t afford care, the local authority is responsible for ensuring you get the help you have been assessed as needing. They will assist based on a financial assessment, and care will be arranged based on your eligible needs.

Understand Your Options

Paying for care can be complicated, but we are here tpo help. Whether you’re self-funding or looking for local authority or NHS funding, understanding the different care funding options or the benefits that you may be eligible for

At Care Navigators, we’re here to support you in navigating this process, from funding your care to finding the best care solutions for your unique situation.

Book an appointment to find out if you should be paying for your care, what benefits you are entitled to and what financial assistance is available for those needing care and support